Stable cotton yarn spreads and better cotton availability will support credit profiles

A rebound in exports and favorable domestic demand are expected to drive India's cotton yarn industry to a 7-9% revenue growth in the current fiscal year, up from a modest 2-4% growth in the previous fiscal year. An uptick in volumes will primarily drive this growth, supported by a modest increase in yarn prices.

Fashion Guru

Operating margins, after witnessing a recovery last fiscal year, are expected to see a further uptick of 50-100 bps this fiscal year, owing to stable cotton yarn spreads and better availability of cotton through the Cotton Corporation of India (CCI).

An analysis of 70 cotton yarn spinners, which account for 35-40% of the industry revenue, indicates as much.

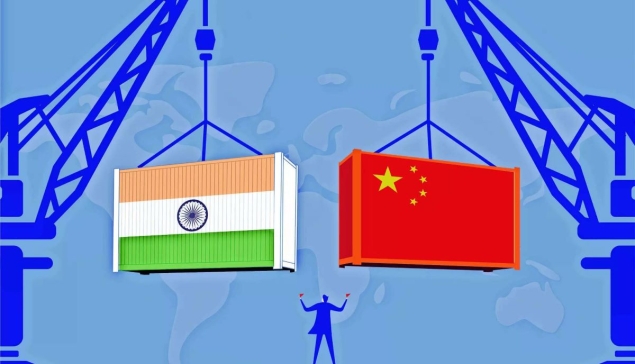

The primary driver for the revenue uptick in fiscal 2026 will be the rebound in yarn exports to China. Exports account for ~30% of the industry’s revenue, of which China accounts for ~14%.

Join our group

In fiscal 2025, India’s yarn exports to China declined compared to prior fiscals on account of an exceptionally high cotton production in China last fiscal. This resulted in a 5-7% de-growth in India’s total cotton yarn exports.

However, this is likely to reverse in the current fiscal with yarn exports seeing a 9-11% growth as exports to China recover, driven by normalization of their domestic cotton production.

Says Gautam Shahi, Director, Crisil Ratings Ltd., “This is likely to benefit Indian spinners as they will leverage steady domestic cotton production in the current cotton season and regain their market share.

Moreover, India's position in textile exports to the US remains competitive given the higher tariff on China (a key competing nation in home textile exports), which is expected to support the 6-8% revenue growth for downstream industries (home textiles and readymade garments) this fiscal year.”

On the raw material front, CCI's significant cotton procurement in Cotton Season 2025 will ensure steady cotton availability, minimizing inventory losses and boosting spinners’ profitability by 50-100 bps this fiscal year, after a 100-150 bps recovery in fiscal 2025.

Says Pranav Shandil, Associate Director, Crisil Ratings Ltd., “Driven by improved operating performance, credit profiles, which showed signs of recovery last fiscal year, will remain stable this fiscal year.

Meanwhile, capex for cotton yarn spinners will remain moderate, with only select players undertaking capital expenditure, which will limit the need for significant debt additions.

Additionally, steady cotton availability will lead to lower inventory holding, reducing the requirement for significant incremental working capital financing.”